Energy Outlook Infographic: 2023 Update

Our Energy Outlook Infographic 2023 Update gives you a visual representation of crucial data shaping the industry. As we help companies in the liquid bulk and chemical supply chain, we like focusing on the energy markets, the usage of oil, and the outlook for liquid fuels.

Energy Outlook Infographic 2023 Review

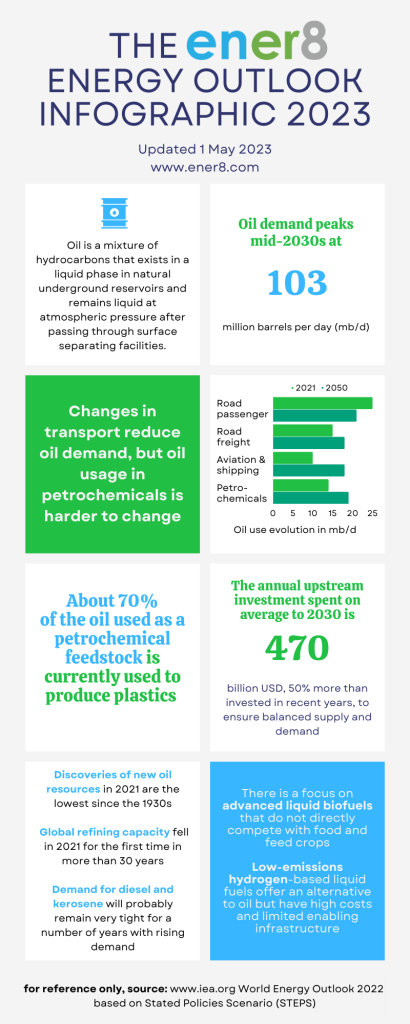

Oil is a mixture of hydrocarbons that exists in a liquid phase in natural underground reservoirs and remains liquid at atmospheric pressure after passing through surface separating facilities. Today, the oil market is facing tremendous near-term and long-term uncertainties.

For our Energy Outlook Infographic, we sourced data from the International Energy Agency’s World Energy Outlook 2022. The International Energy Agency (IEA) is a Paris-based autonomous intergovernmental organization established in 1974 that provides policy recommendations, analysis, and data on the entire global energy sector.

For data and forecast, we followed the Stated Policies Scenario (STEPS), which shows the trajectory based on current government policies and those under development globally. The STEPS provides a more conservative benchmark since it does not take for granted that governments will reach all announced goals. The STEPS explores where the energy system might go without considerable additional guidance from policymakers.

Oil demand will peak mid-2030s at 103 million barrels per day (mb/d) based on the STEPS.

Around 10% of cars sold in 2021 were electric. While electric vehicle sales will rise to 25% by 2030, the market for electric and fuel-cell heavy trucks is forecasted to struggle. Road transport oil demand will increase by 1.5 mb/d between 2021 and 2030. Economic growth will also accelerate trade and travel and thus boost oil demand for aviation and shipping by 4 mb/d between 2021 and 2030.

Changes in transport reduce oil demand, but oil usage in petrochemicals is harder to change. The chemical sector was the only sector in which oil use increased in 2020. About 70% of the oil used as a petrochemical feedstock is currently used to produce plastics. However, as the industry is innovative, we will see global average recycling rates for plastics increase from the current level of 17% to 27% in 2050.

The annual upstream investment spent on average to 2030 is 470 billion USD, 50% more than invested in recent years, to ensure balanced supply and demand.

Discoveries of new oil resources in 2021 are the lowest since the 1930s. The IEA Energy Outlook 2022 report also highlights that future production growth will come from US tight oil, the Middle East members of OPEC, Guyana, and Brazil. High oil prices and energy security uncertainties will also result in some countries distributing new rights to explore oil.

Global refining capacity fell in 2021 for the first time in more than 30 years. Following the STEPS, demand for diesel and kerosene will probably remain very tight for some years with rising demand.

There is also a focus on advanced liquid biofuels that do not directly compete with food and feed crops. This focus is vital given the disruptions in the food supply chain. According to the IEA Energy Outlook 2022 report, liquid biofuels will grow from 2.2 million barrels of oil equivalent per day (mboe/d) in 2021 to 3.4 mboe/d in 2030.

Low-emissions hydrogen-based liquid fuels offer an alternative to oil but have high costs and limited enabling infrastructure. New projects and lowering costs will be critical to boosting the use of these fuels in the future.

Useful blog posts

You may also be interested in blog post 1 – Energy Transition: What Is The Impact On Big Oil, and blog post 2 – The Best Advice For Liquid Bulk Commodity Traders.

Recommended Infographics

Chemical Market Facts & Figures Infographic: 2023 Update

Energy Transition Infographic: 2023 Update

Merchant Fleet Infographic: 2023 Update

Tank Container Infographic 2023 Update

Tank Terminal Infographic: 2023 Update

Photo Credit: ener8